Shares of PSU Insurance companies including LIC, GIC and New India Assurance surge up to 17%

Shares of public sector insurance companies Life Insurance Corporation of India (LIC), General Insurance Corporation (GIC-Re) and the New India Assurance Company (NIACL) jumped up to 20 percent on November 24 morning.

What’s driving the rally in PSU insurers?

Analysts tracking the sector believe that there are no fundamental reasons for the rally in the PSU insurance space. In fact, the financial results for the September quarter were largely disappointing, but there are other ancillary factors which may be responsive for the up move in these stocks, they told CNBC-TV18

A potential factor behind the sharp rally in PSU insurers could be their low public float. Across the board, these companies exhibit notably low public float percentages. For instance, government holds 85 stake in New India Assurance, while 9 percent is held by LIC and 1 percent by GIC-Re, which leaves just about 5 percent of public float.

Follow our market blog to catch all the live action

Similarly for GIC-Re-Re, 86 percent stake is held by government, LIC holds 9 percent stake leaving 5 percent public float. For LIC, government holds 96.5 stake which leaves just 3.5 percent public float. Often, stocks with such low public float show large moves on low volumes.

LIC shares jump on product launch news

LIC jumped nearly 10 percent after the insurance behemoth said it lined up three-four product launches in the coming months to achieving double-digit growth in new business premium in the current financial year.

“We are projecting double-digit growth over the last year. We are going to achieve that because a recent trend is showing an uptick in individual retail business. In order to further reinforce our commitment, we are going to launch some new attractive products,” LIC chairman Siddhartha Mohanty said.

The stock ended 9.7 percent higher at Rs 677.70 on the National Stock Exchange.

Also Read | LIC to launch 3-4 products for double-digit growth in new biz premium in FY24: Chairman

General Insurance Corp at a 52-week high

GIC-Re shares, too, were in demand, with the stock surging 19 percent to hit a fresh 52-week high of Rs 316.00. The sharp rise comes a day after the company said that AM Best re-affirmed the existing ratings and additionally assigned India National Scale Rating (NSR) to the company.

The stock trimmed some gains to end 15 percent higher at Rs 304.45 on NSE. In the past two weeks, GIC-Re has risen around 30 percent.

On the financial strength scale, AM Best assigned a B++ (good) rating to GIC-Re, and revised the outlook to “positive” from “stable”.

It also assigned a bbb+ (good) rating to long-term issuer credit, accompanied by an upgraded outlook to “positive”. GIC-Re also received an aaa.IN (exceptional) NSR rating with a stable outlook.

New India Assurance zooms

NIACL jumped around 20 percent to hit a fresh 52-week high of Rs 209.00, a day after the insurer said analysts and institutional investors will meet senior management in Mumbai on November 29. The stock has jumped 36 percent in the last five sessions.

Also Read | NIACL surges to new 52-week high on investor meet announcement

The NIACL management will be represented by CMD Neerja Kapur and other top officials during the meeting which is keenly awaited after the firm reported a one-off loss in the September quarter.

On November 24, the stock ended 20% higher at Rs 209 on the National Stock Exchange (NSE).

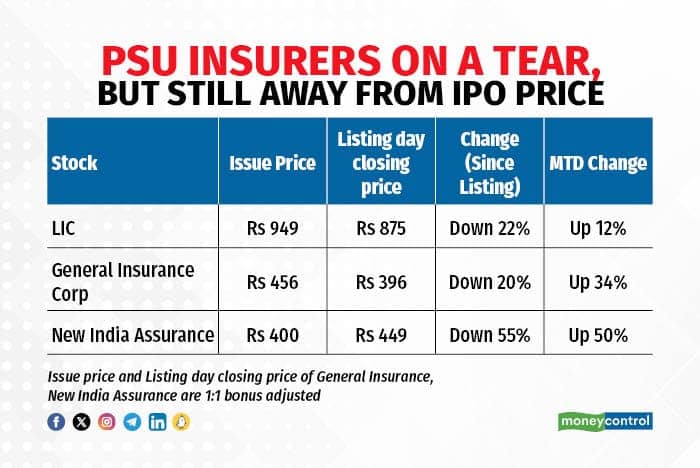

Stocks still away from issue price

Despite the sharp rally, the three PSU insurance stocks are still away from the issue price. New India Assurance’s IPO price was Rs 400 per share (1:1 bonus adjusted). The stock has to double from current levels to reach its issue price.

GIC Re’s IPO price was Rs 456 per share (1:1 bonus adjusted) which means the stock is still 44 percent away from its IPO price. LIC is also nearly 30 percent away from reaching its issue price of Rs 949 per share.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.